Gardens To Visit

Visit a PHS garden or landscape to help build stronger social connections with your community.

For Neighborhoods

Explore programs that create healthy, livable environments and increase access to fresh food.

For Gardeners

Engage with PHS on gardening, whether you’re an expert or a beginner.

About Us

Get to know our story, become a part of our staff, or see what is in the news with PHS.

Planned Giving

Gifts from Retirement Plans During Life

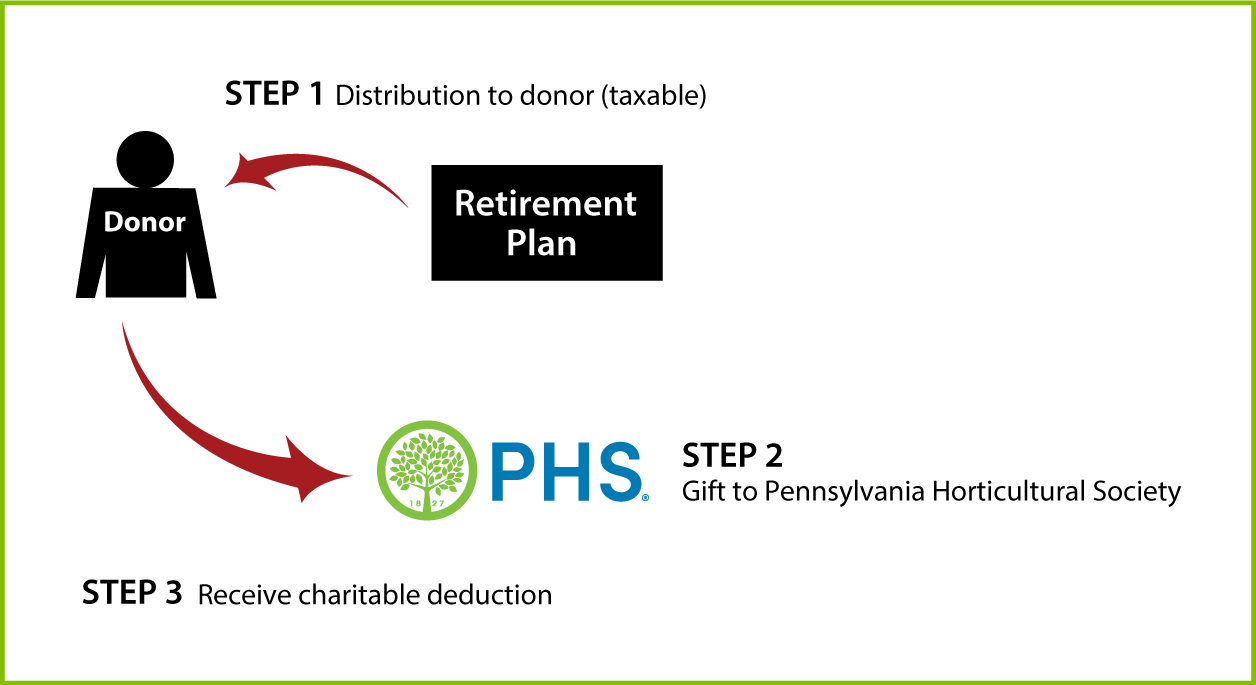

How It Works

- You take a distribution from your qualified retirement plan or IRA that is includable in your gross income

- You make a gift of the distribution or of other assets equal in value to the distribution

- You receive an offsetting charitable deduction

- If you are 70½ or older, read ahead about the IRA rollover opportunity available to you

Benefits

- You may draw on perhaps your largest source of assets to support the programs that are important to you at PHS

- The distribution offsets your minimum required distribution

- If you use appreciated securities instead of cash from your distribution to make your gift, you'll avoid the capital-gain tax on the appreciation

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Shoshana Milovsky |

Pennsylvania Horticultural Society |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer